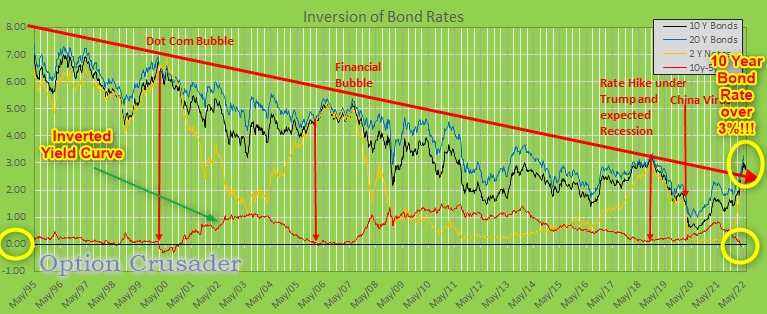

10 Year Bond Rate is over 3% and Inverted

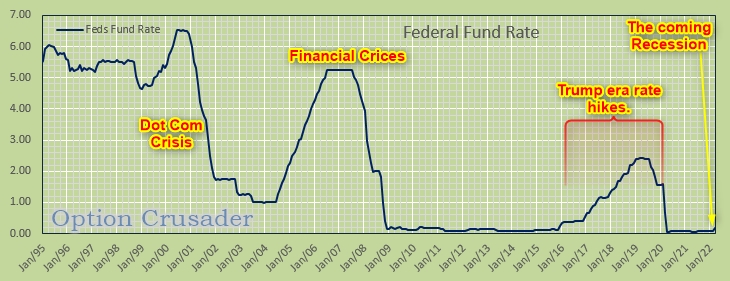

Many of us were talking about the possibility of an inverted yield curve since a year. It is a leading indicator for a recession and closely watched. It was immanent at the end of 2018. Prices started to go up slightly, Powell hiked interest rates because under Trump the economy was full throttle forward. And I agree with that because you cannot grow too fast. It would not be sustainable and also drives inflation.

He hiked several times during 2018, stalled in 2019, reversed them in late 2019 and then the thing hit in early 2020 and the rates collapsed.

What is the inverted Yield Curve

Now, every time we had an inverted yield curve a recession hit. But every time so far we had higher interest rates, which should be built up during economic growth. Slowly but steady.

A yield curve illustrates the interest rates on bonds of increasing maturities.

An inverted yield curve occurs when short-term debt instruments carry higher yields than long-term instruments of the same credit risk profile.

Inverted yield curves are unusual since longer-term debt should carry greater risk and higher interest rates, so when they occur there are implications for consumers and investors alike.

An inverted Treasury yield curve is one of the most reliable leading indicators of an impending recession.

https://www.investopedia.com

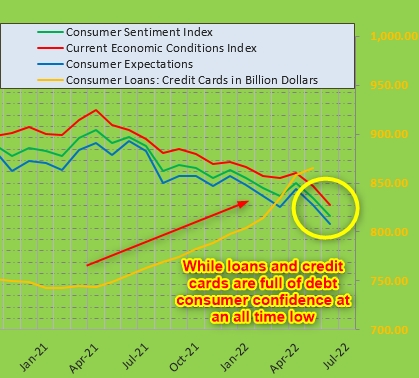

There is no confidence in the economy

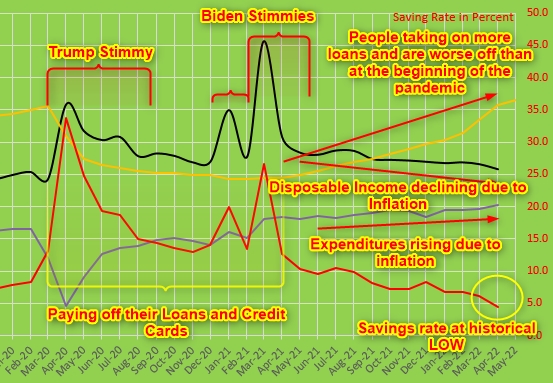

Investors do not have confidence in short term economical development and hence to carry “more” risk bond rates go up. When the recession finally will arrive, end of year or even autumn, there is NO cushion from where we could lower interest rates to stimulate the economy. We are at the bottom already, see graph. More to the contrary, with a runaway inflation the FEDs will be forces to sell their assets to fight bond rates and increase rates to cool inflation.

But raising interest rates in a stagflation, which we have, or coming recession, which will come will crash the economy even more. It is the opposite of what should happen. In an economic uptrend you build up interest rates and you lower them in an down turn.

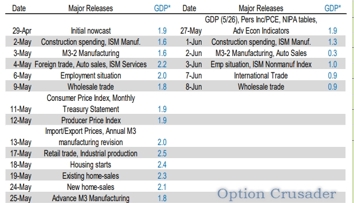

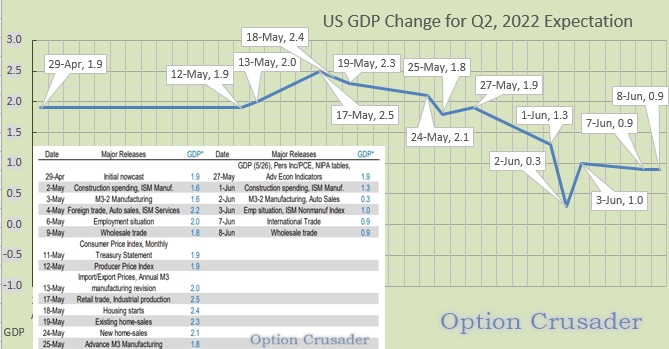

GDP Outlook

Another hit for the Biden Regime. Last GDP numbers came out NEGATIVE. The US economy contracted by 1.4%. If you get two hits in a row you are in. What are the expectations for the GDP?

GDP NOW is down grading the numbers by the week. It started with a weak 2% and is now cut in half. I would not be surprised when the numbers come out negative again. We will see Q2 numbers in July. If the FED will stop hikes they will hike inflation even faster. If they will hike and they should 100 bsp they will crash the economy! The stock market is already sluggish and only afloat because retail traders still buying the dip. They will get slaughtered. Guaranteed.

Conclusion

A Recession is coming and so a market crash. There is no way out. The FED is way behind the curve and not even catching up. The smart money already left the stock market. Too risky.

Sell Call Credit Spreads or buy long Puts, longer term. If you have the margin sell Stocks first and buy them back later when they are cheaper.