Where is the Economy going? Up or down?

Usually a recession starts in the manufacturing sector. And when the layoffs are coming people also start to save on services. But we can see that the development in the service sector is much more dramatic. Inflation is eating everything here.

How does it work?

Due to monetary policies, money printing and debt creation, inflation is on a 40 year high. More Dollars chasing fewer goods. Money injection into the market should follow the GDP growth. When the economy gets too hot you take money out of circulation to cool off the heat. Make things more expensive, Mortgages i.e. This should have been done in the winter of 2020 under Trump. When the economy is stagnant or bad you can put money into the circulation to stimulate. Make things cheaper, loans i.e.

How to stimulate?

The Central Bank buys corporate bonds or mortgage backed assets, MBAs, and put them on their balance sheet. The local or national banks receive Dollars for that. Printed money. They in return take the money and provide cheap loans. They call you up and give you a line of credit. You run to the dealership and buy a new truck. Then the trucks are sold out. Then the people buy used trucks until they run out. With all this money the people were buying goods for did not create a thing in values. Too much money chasing fewer goods. Prices going up due to too much money printing. Central Banks create inflation AND Government spending programs, Free Money, which in return needs debt and printed money, which of course again is provided by the Central Bank.

Inflation is always a monetary problem

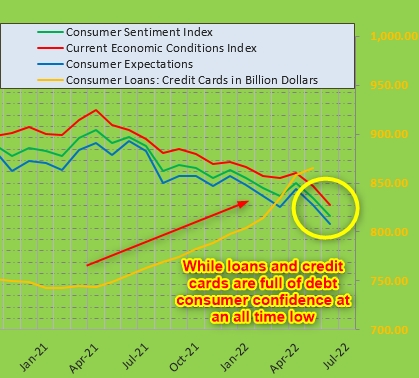

They artificially created a super demand, which drives super inflation. And with rising inflation in the service sector and personal LOC already spent, people step away from certain things: vacation, air lines, hotels, cruises, appliances etc. We can clearly see that inventory is rising and so is pricing. Consumers start to reject the prices. With increasing inventory, new orders fall and hence business activities. Employment is always a lagging indicator but new orders and inventory are leading indicators. Airline tickets are also dramatically inflated due to over regulations and the war of the Biden regime against the energy industry. Another shortage created by the government. The support of the Ukrainians in the war against Russia is also inflationary.

Lets look at the Manufacturing Sector

Here we can also see similar movements. But not so dramatic as in the service sector. We also see an increasing inventory and hence, logically a decrease in New Orders and hence production. Layoffs are coming. Prices seem to move into disinflation, the rate of inflation is slowing.

With high inflation consumer spending will decrease, inventory will build and production will slow. With a decreasing production layoffs will come. Hence a recession is at the door step and we need to drastically reduce demand. Inflation is demand driven.

And when the consumer stops spending corporate earnings will go down as well. And when earnings go down the stock market will crash. That’s why I am short in the market.

How do we know that consumers are running out of money?

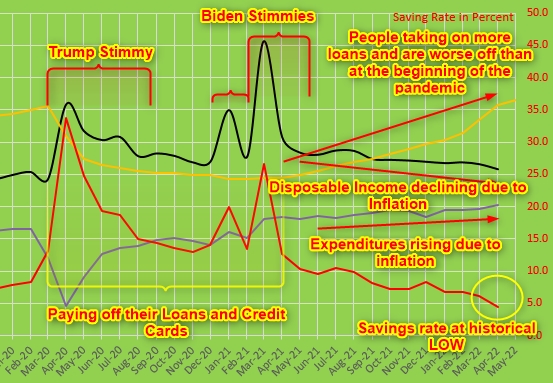

They are telling us so. While with the two huge stimmy packages the people paid off their loans and credit cards, one under Trump and two in short order under the Biden Regime, a few months later we see an increase in consumer loans. Why? The Feds kept pumping money to the banks and then the banks called you to give you a loan!! This is what we are seeing here. Not good!

Another Graph to make things clear. Disposable Income

In the following graph we can see exactly when and how people paid off their loans and credit cards. Under Trump and then under Biden. But the Feds kept pumping money into the circulation and are the reason for the inflation we have. Biden and Trudeau both are responsible for almost a 100% increase in gasoline prices. They know it and they love it. Its done on purpose.

We clearly can see that with the stimmy money people paid off their consumer loans as we call it. The yellow line below. It is clearly to see how the saving rate went up and loans came down. The people made a smart move. Take the money and pay off expensive loans. I did so too. But the FEDs and so the Bank of Canada kept pumping money to stimulate an overheated economy.

Now, when I see that the disposable income is declining and the savings rate is at an historical low whilst at the same time loans are at before pandemic levels, I know we are not doing well. A recession is about to break in. The consumer spent all the money they have. Otherwise disposable income would NOT decrease and the Savings Rate would be at around 7%. Mark my word.

Conclusion

A perfect storm is brewing. The perfect storm is a combination of high inflation and a stagnant economy threatened by three wars (Ukraine and Russia, Israel and Iran, China and Taiwan) and the potential collapse of the Chinese economy and over regulations that are creating massive shortages, transportation chaos and supply chain interruption. It is coming my friends. It’s coming.

- War on cheap and reliable energy is very inflationary

- War in Ukraine and the fiscal support for it is inflationary

- Excessive social programs are inflationary

- QT, Quantitative Tightening will create a liquidity problem.

- Increasing rate hikes will increase rates for loans and line of credits and increase defaults

- China might drag the world economy down due to

- Lockdowns

- Real estate market crash

- Liquidity problems

- We will see disinflation this summer

- If the GDP in July comes out negative we are in a recession

- Most of the companies traded are in recession mode. Means they lost more than 20% value

- Housing market will collapse with increase of rate hikes. So will the construction industry.

- Layoffs in autumn

- Recession in autumn

- Market Crash within the next three months