Consumer Sentiment, Inflation and Market Crash

What is the UMCSI Showing to us?

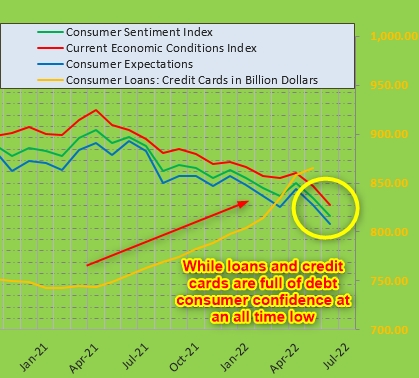

The US economy is deteriorating further. After the Virus the sentiment recovered slowly and peaked with Biden taking office in expectations of better times ahead. At the same time inflation kicked in due to massive overspending. Inflation is always a monetary problem of too much money in circulation. Even fiscal policies (“Free money” programs) are rooted in monetary policies. If the government ask for money nobody has at hand, the FEDS issue debt and create the liquidity needed to pay for those programs. This is important to understand. They create money out of free air.

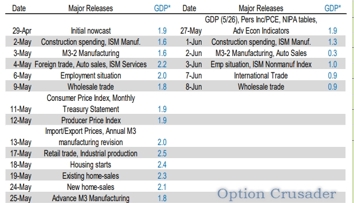

Follow GDP NOW from the Atlanta Feds and we will see how growth is constantly fading away. Will we have a second quarter in the red?

The UMCSI is at its lowest level since the virus was released, which was the lowest ever since, even under Bush, Obama and Trump. We also had the first Quarter of the GDP coming in negative this year. Two in a row makes it officially a recession.

And Stocks?

We also see that the S&P 500, NASDAQ, Russel 2000 are about to hit 20% below the most recent high. A 20% correction will be seen as a recession in the broad market. Why? Because earnings of the underlaying companies will come in lower than they used to do. Also, the higher the stock price gets the more is expected for their growth. Relatively to their value the stock has to grow more to produce the same ROC. Otherwise the EPS (Earnings Per Share) will slump and investors will look for other opportunities. This makes the stock market less attractive the more it grows. Other investments are also less risky. And, i.e., about 50% of the IWM, Russel 2000, cannot serve their debts!!

The Party is over my Friends.

Big Tech stocks are down a lot.

Meme stocks lost all their gains they made since the start of 2020. Congratulations to the Ape Army.

What’s up with the Bitcoins and their kind? How are those speculative investments doing?

And new Retail Traders, the mom and pops, are still massively pumping money into the stock market, buying the dips, trying to catch a falling knife. Bad idea.

They all will be eaten by sharks and I will be one of those taking their money!

Money Stock and Circulation

For example. When the FEDs or any other central bank is buying billions of Dollars in Mortgage Backed Assets, MBAs, from banks or buying State or corporate Bonds they put those assets (Debt Investments) on their balance sheet and issue Dollars for it. These federal assets can then be sold if there are international buyers. At least the US Dollar is the world reserve currency and hence attracts international buyers and the US can dilute and export their inflation! And not many countries have this option to unload inflation onto other countries.

By flushing the circulation with money the banks need to do something with it. Cash is a liability for banks and they can only horde a certain amount of it. The excessive amount will be deposited into the Federal Reserve for an interest rate called the Overnight Fund Rate, which stands at 0.32% right now. What can the banks do? They call you up and offer you a loan, HELOC, Personal Line of Credit, car loan, small business loan. They might get 2.5% or 3.5% or for car loans, 7-8%. Thus, this is much more then they would get for depositing the cash at the FEDs. This is flushing the circulation with free money.

What is the Outcome of Excessive Money in Circulation?

Now when the bank calls you up and offers you a cheap loan you take it. Interest rates are low and you can do something with it.

- Take the money and buy dips in a collapsing stock market. Markets always go up.

- Buy a new car or have a down payment for a house since interest rates will never rise.

- Get a business loan since the economy is hot and always gets better.

This is when you buy cars with money that is created out of thin air. There is only an IOU in the deposit box of the FEDS. Nobody had produced any more cars or anything. More money is chasing fewer good. This “free money” only increased the demand side of the economy. That’s why we see a shortage in new cars and used car prices are sky rocketing. Everybody got a personal LOC and they buy cars. And this is the major cause of inflation.

What else is driving inflation?

- Inflationary are social programs. Remember, it is “free” money that can be spend freely. But in reality “FREE” money is DEBT. It is like spending money of your Credit Card. One day you have to pay it back or sell your debt to someone else!

Some one might ask you how wealthy are you, what’s your net worth? And the answer will be ASSETS minus LIABILITIES. You have $1,000 at hand but $3,000 in debt, then you are $2,000 negative net worth. And if you can only produce $1,000 a month, your Cash Flow, and lets say you have to serve your debt with $200, than your Free Cash Flow is only $800. That’s the basic. That’s how it works. Thus, I am not saying all social programs should be scrapped. What I am saying is that they are inflationary at their base! Some social programs are important and should be kept, others not. They reduce your free cash flow. Just one major thing to keep in mind what it does. But most people do not understand how it works and they stay willfully ignorant. - Inflationary are wars. Wars are the double whammy. You sell machinery to destroy an economy for years to come. Not only are we fueling the demand side of the Military Industrial Complex but we are also destroying the demand and supply side of a country, factories etc. and at the same time we indebt them big time. But there are not much choices. A war should haven been avoided by other means.

As an example, Ukraine will enjoy decades of unbelievable growth after the war if they can stay free. - Inflationary can also be the USD compared to other major currencies if it loses in value. The more you dilute the USD, printing money in a stagnant economy, the more it loses in value. Since the USD is the worlds reserve currency, which means most of all transactions are done in USD, imports will increase and drive the Dollar value up. This will contribute to a liquidity problem and increase the value of the Dollar. Mainly imported commodities will increase the value of the USD until a recession hits and the demand winds down and so do prices. Commodities seem to be a good investment until recession hits!

How should the Money Stock be handled?

Money in circulation should follow the the Gross Domestic Production. And for the USD also the World GDP.

(M2SL x M2V) / GDP = Price Level. Google Milton Friedman and he explains it very well.

An economic professor and part of the FEDS in the 80s.

https://www.youtube.com/watch?v=GJ4TTNeSUdQ&t=2s

https://www.youtube.com/watch?v=B_nGEj8wIP0

The more you produce the more Dollars you need in circulation to keep prices at gun point. You need to print money to keep the Dollar at bay. Otherwise the Dollar gains value and becomes more expensive. This is not inflationary. This is deflationary since less Dollars are chasing more goods.

The more an economy is slowing down, the fewer good are produced, the fewer money changes hands, the more money should be taken out of circulation to keep prices stable. If you do nothing inflation will rise. More cash is chasing fewer goods, right? Later consumer will tighten their wallets due to a slowing economy and too high prices. This will be first disinflationary (slowing the rate of rise) and then deflationary (Prices moving down). Disinflation I expect to show this summer and recession in autumn.

But when you are way behind the curve or the last to leave the party, due to the addiction to the COCAINE in a stagnant economy, inflation is already on the rise. When inflation reached a “high point”, lets say at 4.1% like in April 2021, you should have started to reduce liquidity in order to take money out of circulation by raising rates and /or selling assets or simply stop buying more assets like the FEDS did from 2015 to 2018. Stop printing money. This would have slowed the economy less shockingly and kept inflation more in check. They did not do it. They kept on fueling cash into the circulation to fuel inflation. This kept the housing bubble growing, the stock market rising out of whack.

I know it is not easy to aim the point in time, when the economy stagnates or recedes. Since those measures are lagging and the effects will be seen 6 months down the road. Monetary policies should be contrarian to the economy. If the economy is doing well, rise interest rates. If the economy is slowing increase asset buying and in a recession lower interest rates. But we have no ammunition left. We are out of options compared to the major previous crisis. Interest rates are at the lowest level, ever. Do we go negative on interest rates? If you keep money in your account you lose it?? Germany has it! The MO will be SPEND, SPEND, SPEND and die.

What will happen to the markets?

Well, Jerome Powell says there will be a soft landing if possible. I say there will be no soft landing because he missed the window to do so. His airplane does not have a working landing gears. The markets will crash and so will the economy due to data I watch. More to come.

Direction of trade? Short the market, go long on Puts or sell Bear Call Credit Spreads until we see a recovery which might still be 50% below our feet. Then at the bottom we sell Iron condors and when the market recovers (20% above bottom) we buy CALLS or sell Bull Put Credit Spreads

Further reading.

More Signs of a Recession, Short the Market